- Sale

- NEW ARRIVALS

- Most Popular

- All Prints

-

Artists

-

ALEC MONOPOLY

ALEC MONOPOLY7 artworks

-

Alex Katz

Alex Katz133 artworks

-

Banksy

Banksy4 artworks

-

Bridget Riley

Bridget Riley1 artwork

-

Damien Hirst

Damien Hirst475 artworks

-

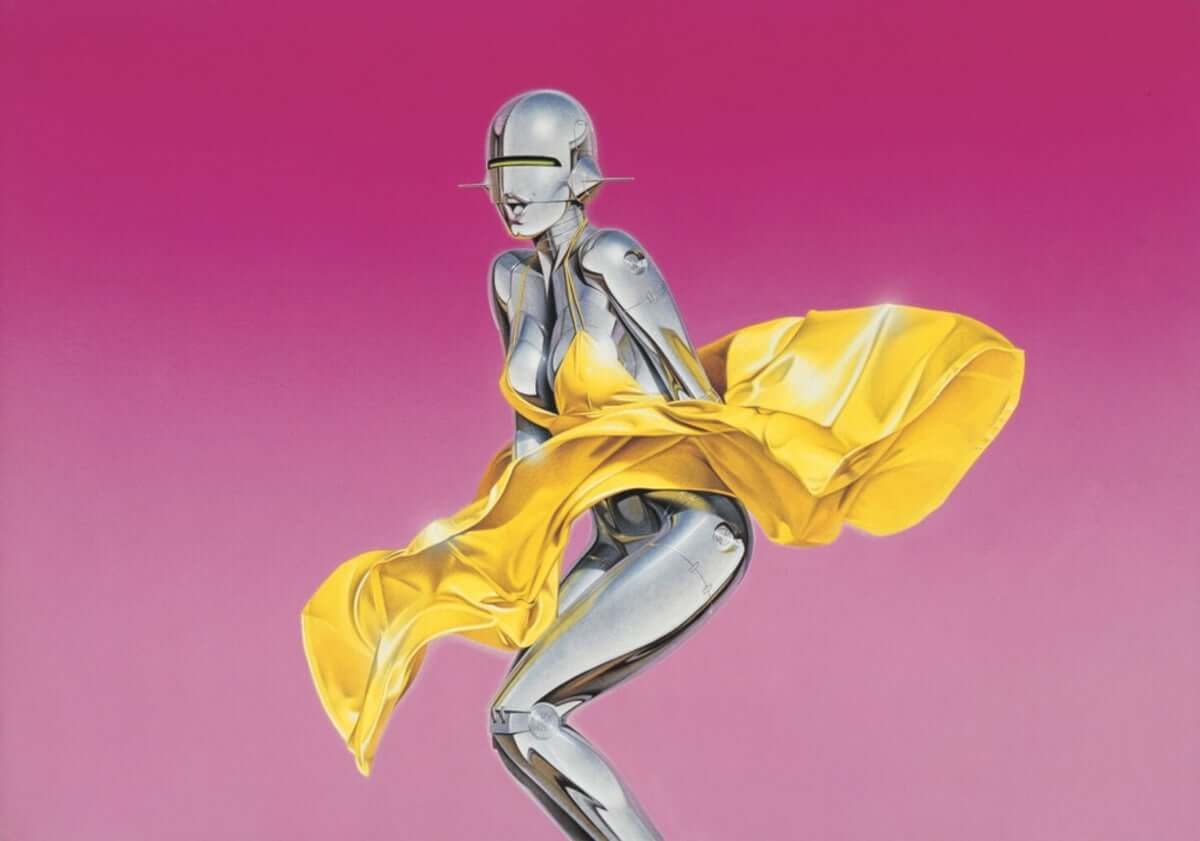

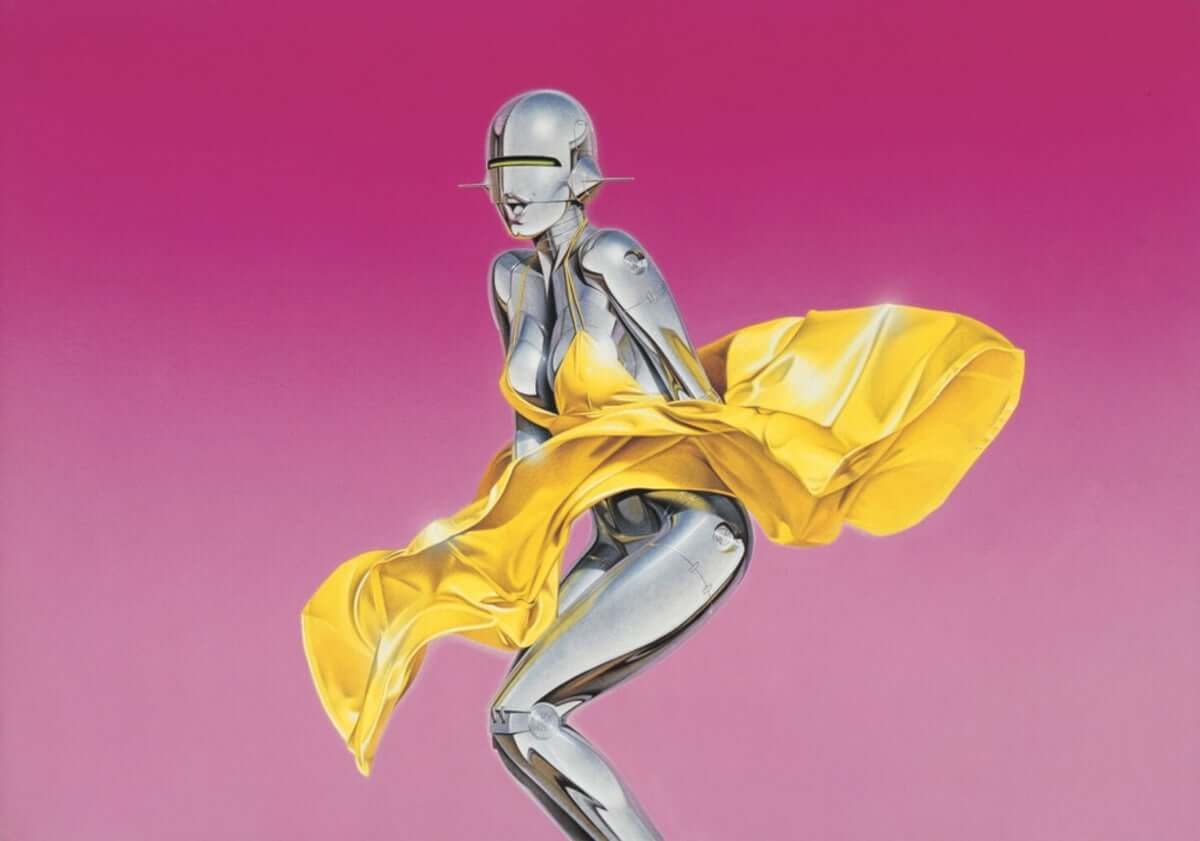

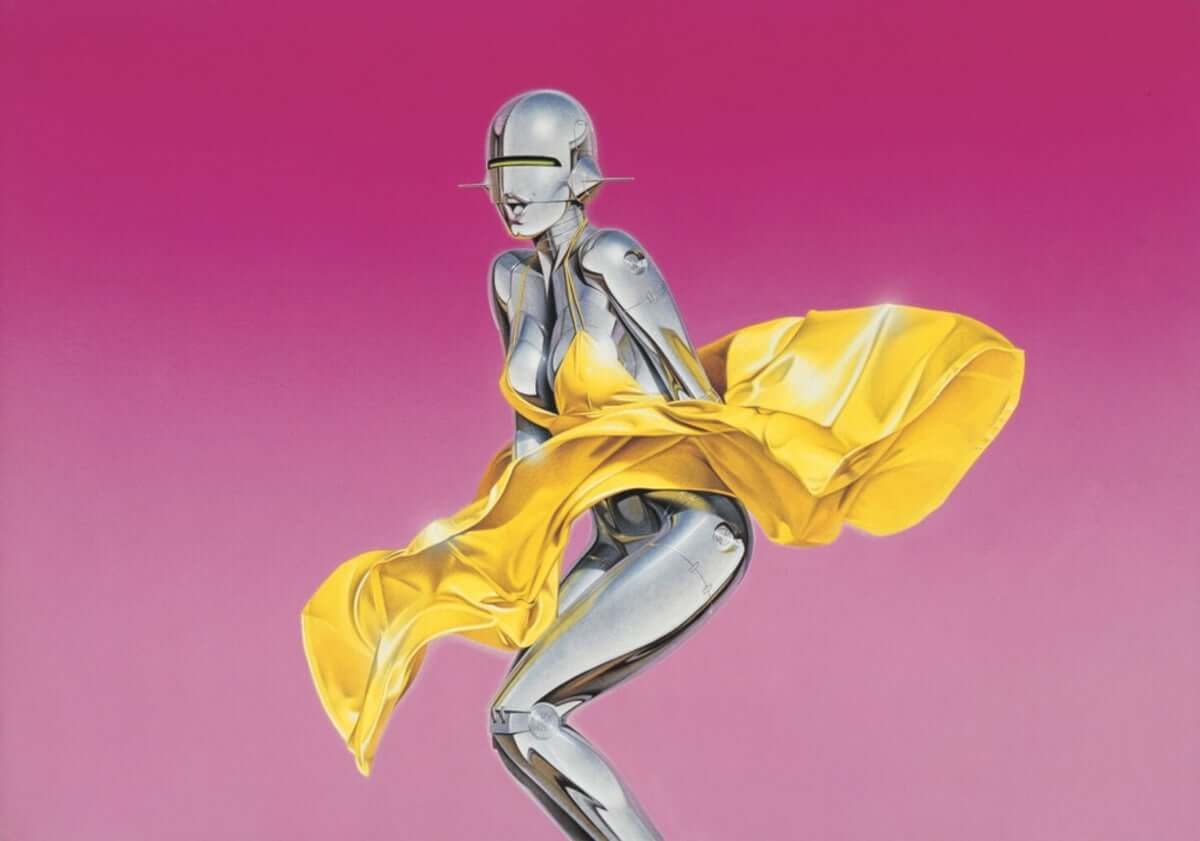

Hajime Sorayama

Hajime Sorayama126 artworks

-

Harland Miller

Harland Miller48 artworks

-

Invader

Invader72 artworks

-

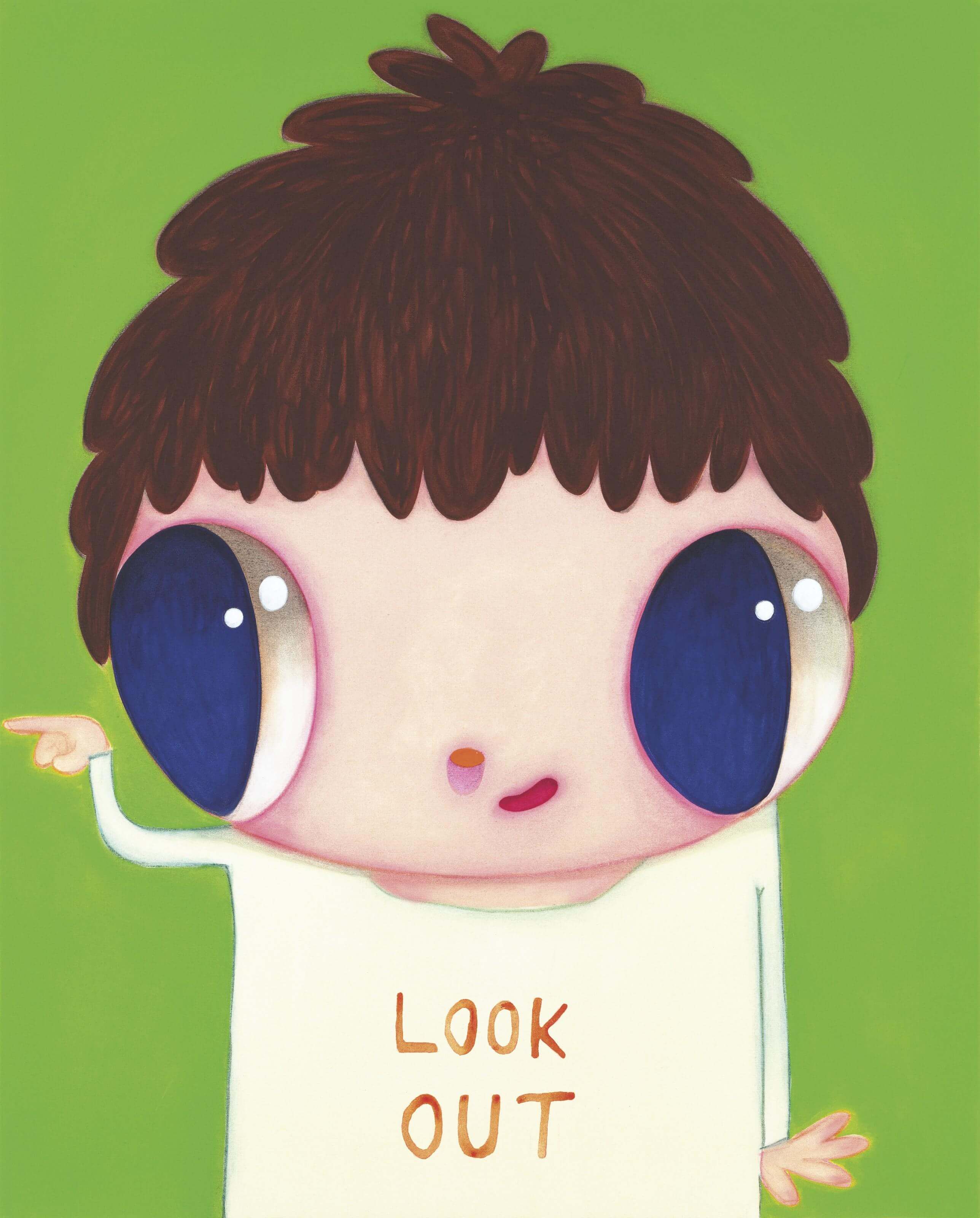

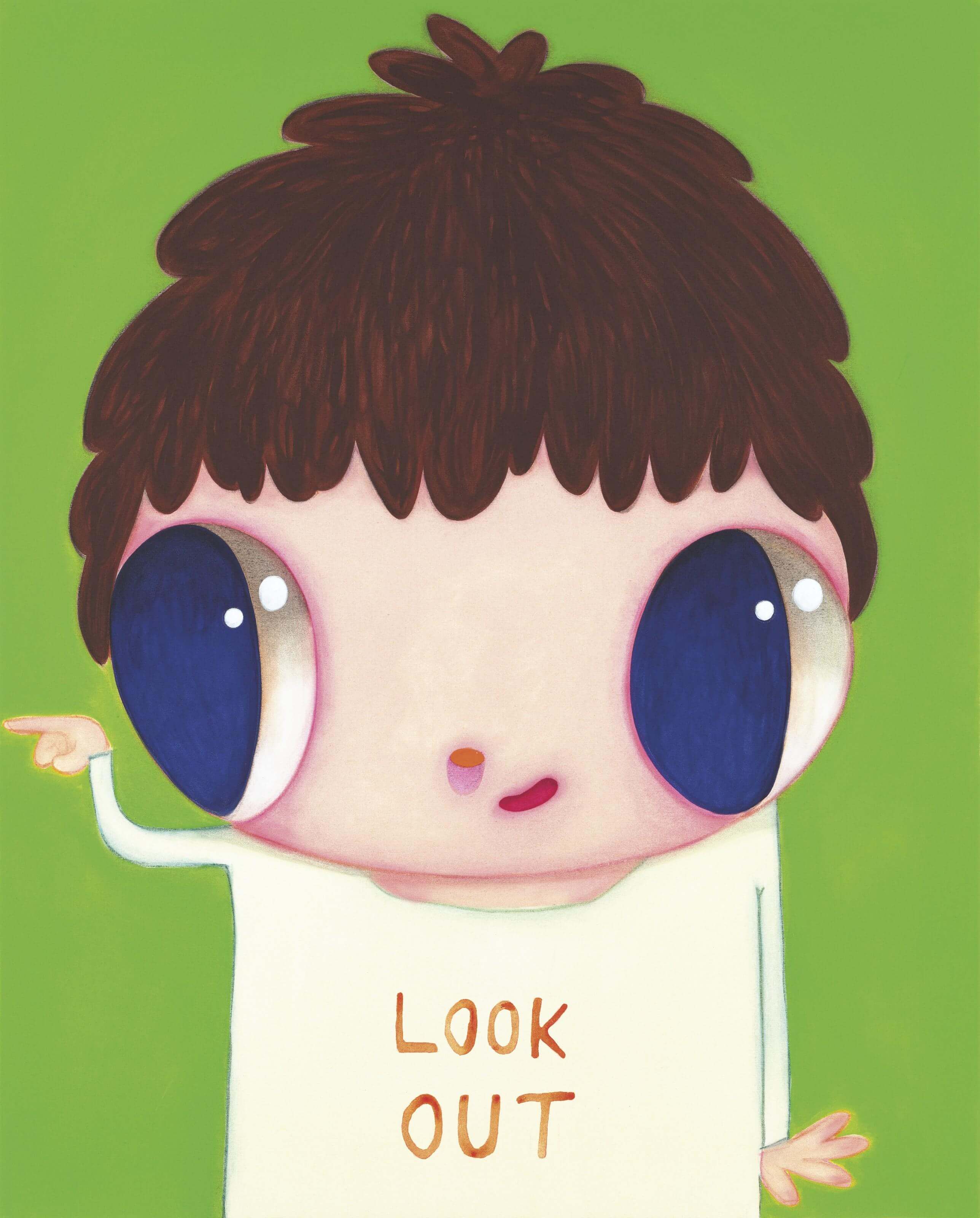

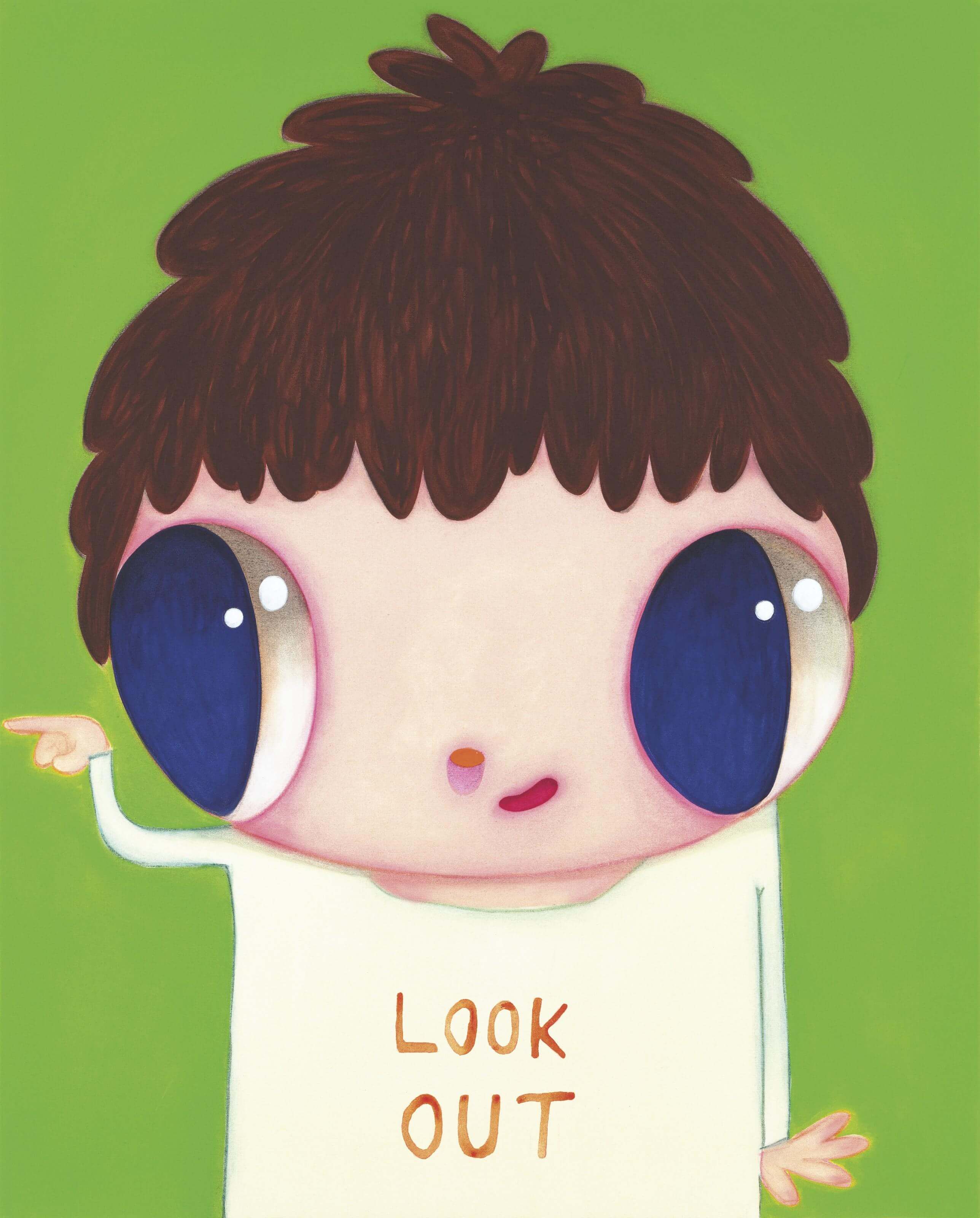

Javier Calleja

Javier Calleja2 artworks

-

Kaws

Kaws105 artworks

-

Keith Haring

Keith Haring192 artworks

-

Matt Gondek

Matt Gondek32 artworks

-

Mr.

Mr.28 artworks

-

Satoru Koizumi

Satoru Koizumi1 artwork

-

Takashi Murakami

Takashi Murakami342 artworks

-

Takeru Amano

Takeru Amano22 artworks

-

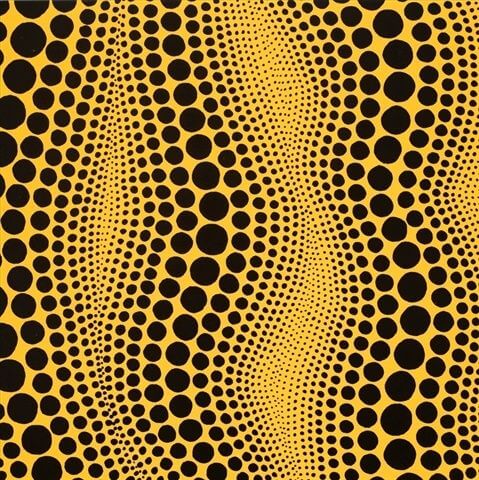

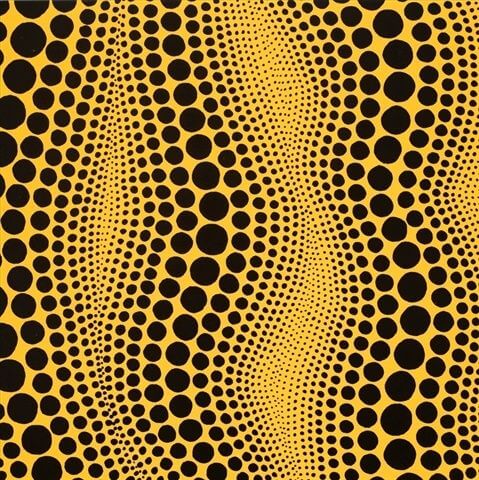

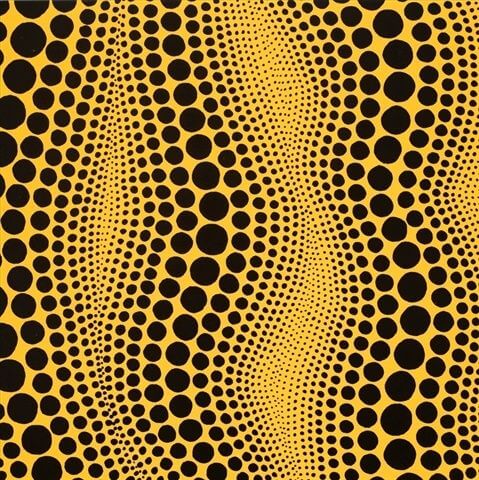

Yayoi Kusama

Yayoi Kusama153 artworks

-

- Sell

-

About

- Sale

- New Arrivals

- Most Popular

- All Prints

- Arists

- Sell

-

About

- the service

- How it Works

- Buy

- What is a print?

- Authenticity Guarantee

- the company

- About

- Contact us

- Login

-

ALEC MONOPOLY

ALEC MONOPOLY7 artworks

-

Alex Katz

Alex Katz133 artworks

-

Banksy

Banksy4 artworks

-

Bridget Riley

Bridget Riley1 artwork

-

Damien Hirst

Damien Hirst475 artworks

-

Hajime Sorayama

Hajime Sorayama126 artworks

-

Harland Miller

Harland Miller48 artworks

-

Invader

Invader72 artworks

-

Javier Calleja

Javier Calleja2 artworks

-

Kaws

Kaws105 artworks

-

Keith Haring

Keith Haring192 artworks

-

Matt Gondek

Matt Gondek32 artworks

-

Mr.

Mr.28 artworks

-

Satoru Koizumi

Satoru Koizumi1 artwork

-

Takashi Murakami

Takashi Murakami342 artworks

-

Takeru Amano

Takeru Amano22 artworks

-

Yayoi Kusama

Yayoi Kusama153 artworks

8 Benefits of Investing in Art

September 06, 2023 4 min read

For centuries, the benefits of investing in art have intrigued and enticed humanity.

From iconic masterpieces that grace the halls of the Louvre to modern creations that ignite discussions and self-reflection, art not only encapsulates our culture, emotions, and chronicles but also presents itself as a potentially rewarding financial venture.

What, then, positions art as a compelling choice for investors in the financial landscape?

1. A Resilient Investment

Art possesses a singular capability to stand the test of time.

Especially the creations of renowned artists or pieces hailing from notable periods, their value often remains untouched, even when global economies stumble.

Take the financial crisis of 2007-2009 as an example.

Where several sectors felt the brunt of economic downturns, the art market demonstrated notable resilience. This is particularly true for blue-chip art—works from globally recognized artists.

Unlike stocks that can plummet overnight based on market sentiment, quality art maintains, or even appreciates, its value. The art market's immunity can be attributed to its impassivity to standard business cycles, geopolitical events, or even technological disruptions.

Investors often see such artworks as haven assets—safe harbors during turbulent financial periods.

2. Diversification of Portfolio

The world of investments can be unpredictable. Stocks, bonds, real estate—all of these are subject to market volatilities.

Here, one of the benefits of investing in art is that it emerges as a unique diversification avenue.

Its value, more often than not, remains untouched by traditional market dynamics. This lack of correlation with traditional assets, as highlighted by Deloitte's comprehensive report, adds a layer of protection against market uncertainties.

By incorporating art into one's portfolio, investors can potentially mitigate risks and secure a section of their investments from the usual market volatilities. As the investment world becomes more complex, having such a non-correlated asset can provide peace of mind, especially during economic downturns.

3. Art as a Tangible Asset

In a rapidly digitizing world, tangible assets like art retain a unique allure. Unlike digital stocks or cryptocurrency tokens, art is something you can touch, see, and feel.

Owning art offers more than just the possibility of financial returns. It is akin to holding a piece of history, a representation of culture, or a manifestation of an artist's emotions and journey.

This tangibility offers a multidimensional experience—while you expect it to appreciate monetarily, it simultaneously decorates spaces, starts conversations, and enhances personal experiences.

The emotional and aesthetic satisfaction derived from viewing a personal art collection is unmatched, making it a truly distinctive asset class.

4. Potential for High Returns

Art's financial potential isn't merely speculative—it has historical precedents. Pieces by artists who later gained significant recognition can appreciate exponentially in value. Jean-Michel Basquiat's painting is just one testament to this.

Another example is the meteoric rise in value of works by artists like Yayoi Kusama and Banksy. While it's essential to note that not all artworks guarantee such returns, with careful selection and a bit of foresight, investments in art can yield returns that far exceed traditional investment avenues.

Investing in emerging artists or spotting trends early can lead to significant financial gains, making art an exciting and potentially lucrative investment domain.

5. Tax Benefits

Governments worldwide recognize the cultural significance of art and often incentivize its purchase and preservation through tax codes.

For instance, in the U.S., the tax system has provisions that encourage art philanthropy. Art collectors can enjoy significant tax deductions by donating art to recognized institutions.

This deduction isn't just limited to the purchase price—it can be based on the artwork's appreciated value.

Moreover, some countries offer reduced inheritance tax rates for artworks lent to public galleries. Such benefits, coupled with the potential appreciation of art, make it a savvy investment both for immediate returns and long-term financial planning.

6. Cultural Legacy and Societal Impact

Art plays an irreplaceable role in shaping cultural narratives and mirroring society's evolution. By investing in art, especially that of emerging or marginalized artists, investors actively support cultural preservation and the continued creation of diverse voices.

Furthermore, collectors play a pivotal role in deciding which artworks are preserved, showcased, and celebrated, influencing which stories get told and remembered in the annals of art history.

This influential role comes with both a responsibility and an opportunity—to ensure that rich, diverse narratives thrive and to champion the voices of tomorrow.

7. The Liquid Art Market

Traditionally, the art world was seen as somewhat exclusive, with sales limited to galleries and elite auction houses.

But times have changed.

With the rise of online art platforms and digital auction spaces, the art market is undergoing a liquidity transformation. Platforms like Artsy and Artnet democratize access, connecting buyers and sellers across continents.

Now, even if an art collector resides in Europe, they can easily purchase a piece from an Asian artist or vice versa. This increased liquidity has not only made the buying and selling process more straightforward but has also opened up the once-elusive art world to a broader audience.

8. Caveats to Consider

Every investment domain has its pitfalls, and art is no exception.

The art market is intricate and can be influenced by myriad factors.

Authenticity concerns, the prominence of art critics, historical relevance, and even societal trends can play a role in determining an artwork's value.

Forgeries have been a longstanding concern in the art world, with fake artworks sometimes fooling even seasoned experts.

Additionally, the provenance or history of an art piece can become a contentious issue, leading to legal battles.

For potential investors, this underscores the importance of thorough research, expert consultations, and due diligence before making a purchase.

Conclusion: Embracing the Multifaceted Benefits of Investing in Art

In the ever-evolving landscape of investments, art stands out as a timeless asset that seamlessly marries tangible returns with intangible values. As we've explored, the benefits of investing in art are profound and numerous.

From offering a protective diversification to portfolios, to potentially providing exponential financial gains, and even fostering cultural legacies, art investment is a journey that rewards both the heart and the wallet.

Moreover, with its resilience in face of economic downturns and its ability to transcend digital boundaries, it offers a unique blend of stability and emotion, a rarity in the modern investment world.

Whether you're a seasoned investor looking for a diversified portfolio or an art enthusiast hoping to merge passion with profits, understanding the benefits of investing in art can be your compass to a richer, more colorful investment horizon.

Leave a comment

Subscribe

Sign up to get the latest on sales, new releases and more …