- Sale

- NEW ARRIVALS

- Most Popular

- All Prints

-

Artists

-

ALEC MONOPOLY

ALEC MONOPOLY7 artworks

-

Alex Katz

Alex Katz133 artworks

-

Banksy

Banksy4 artworks

-

Bridget Riley

Bridget Riley1 artwork

-

Damien Hirst

Damien Hirst475 artworks

-

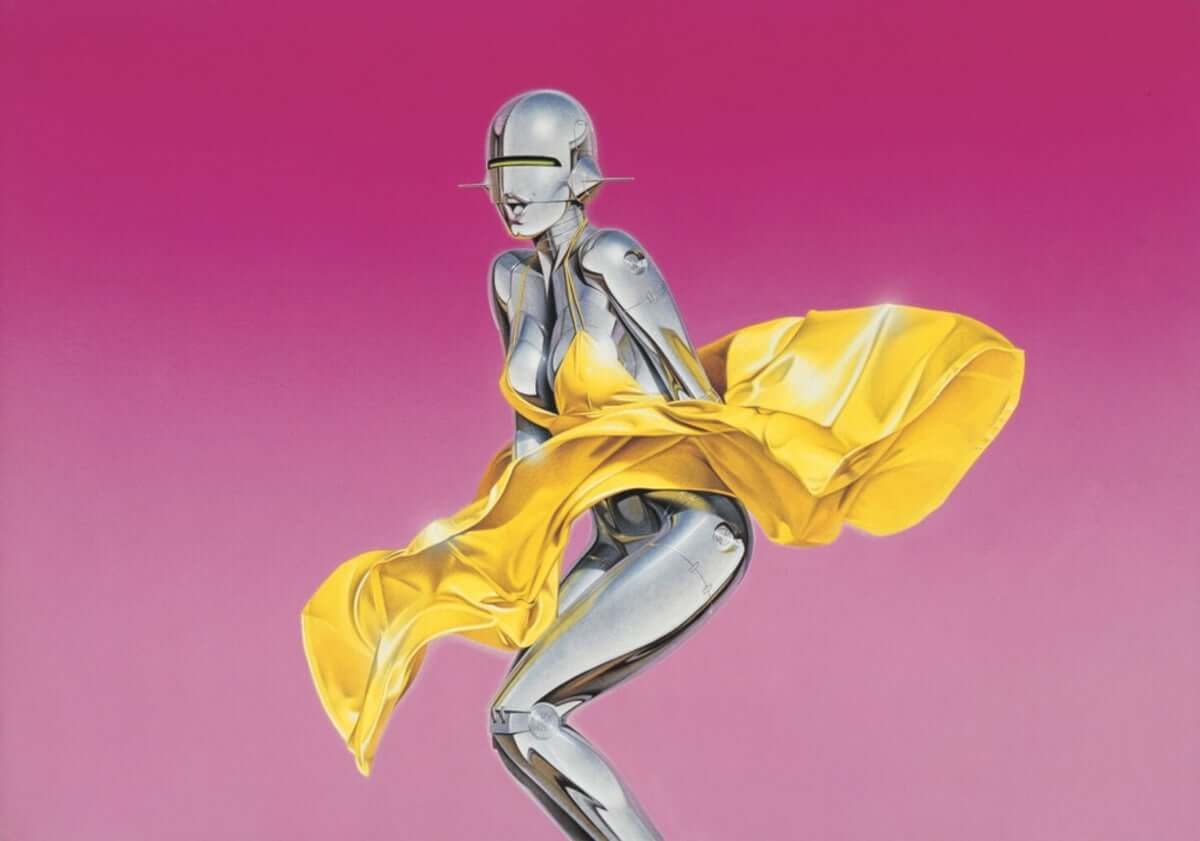

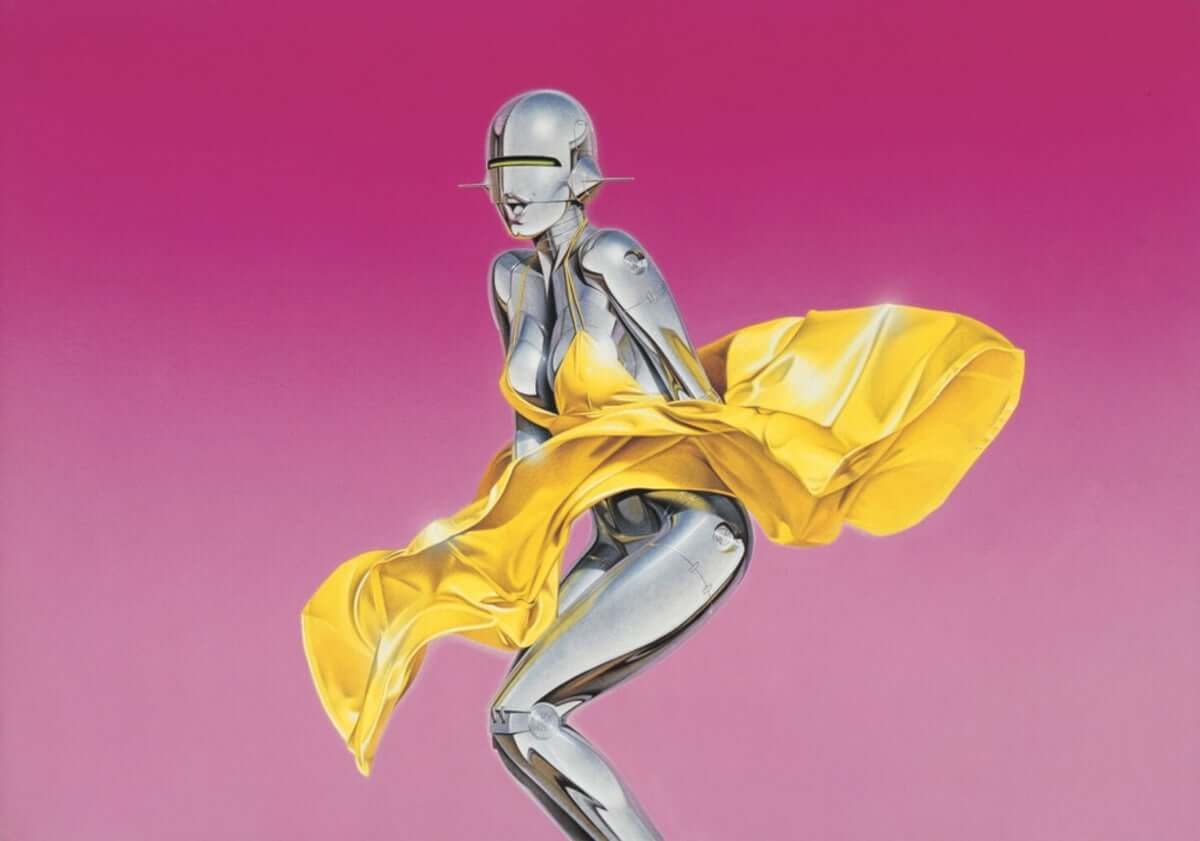

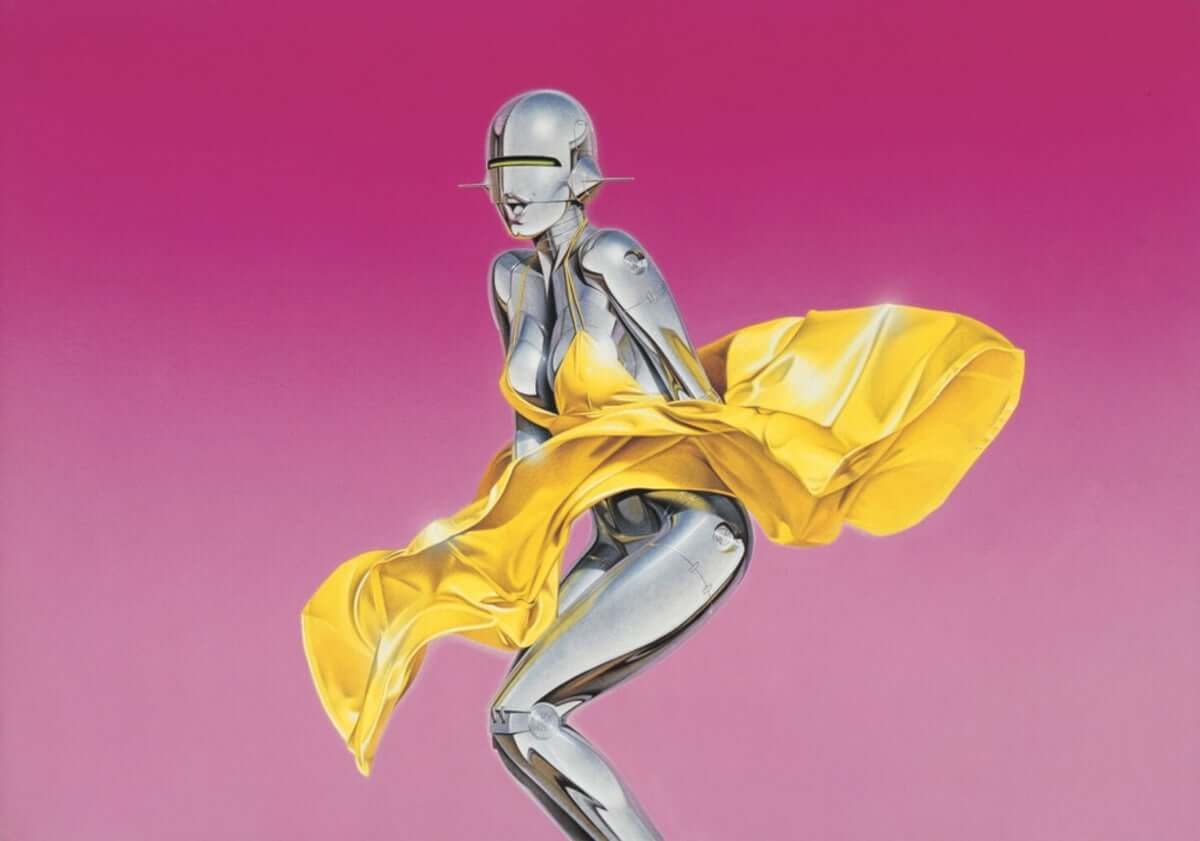

Hajime Sorayama

Hajime Sorayama126 artworks

-

Harland Miller

Harland Miller48 artworks

-

Invader

Invader72 artworks

-

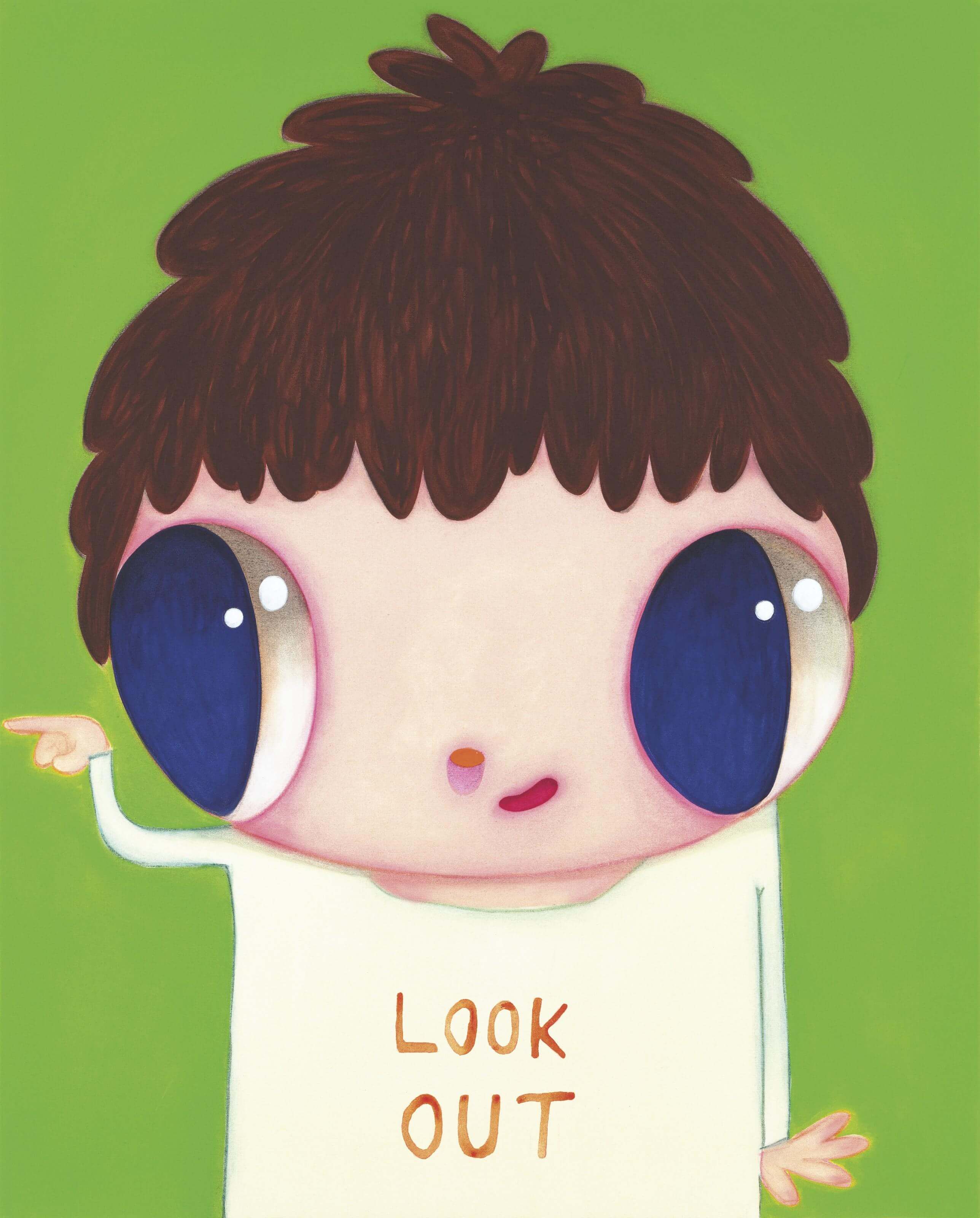

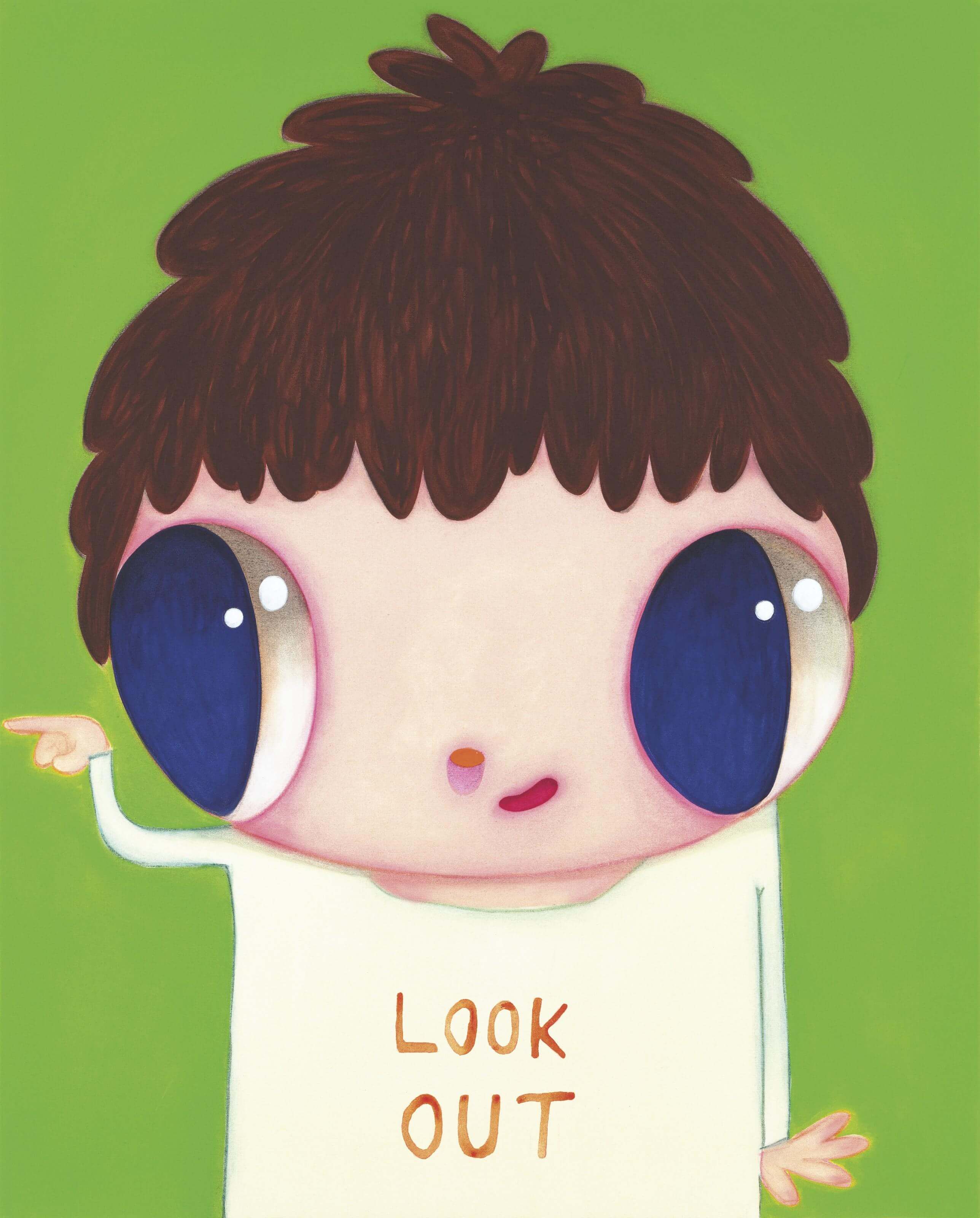

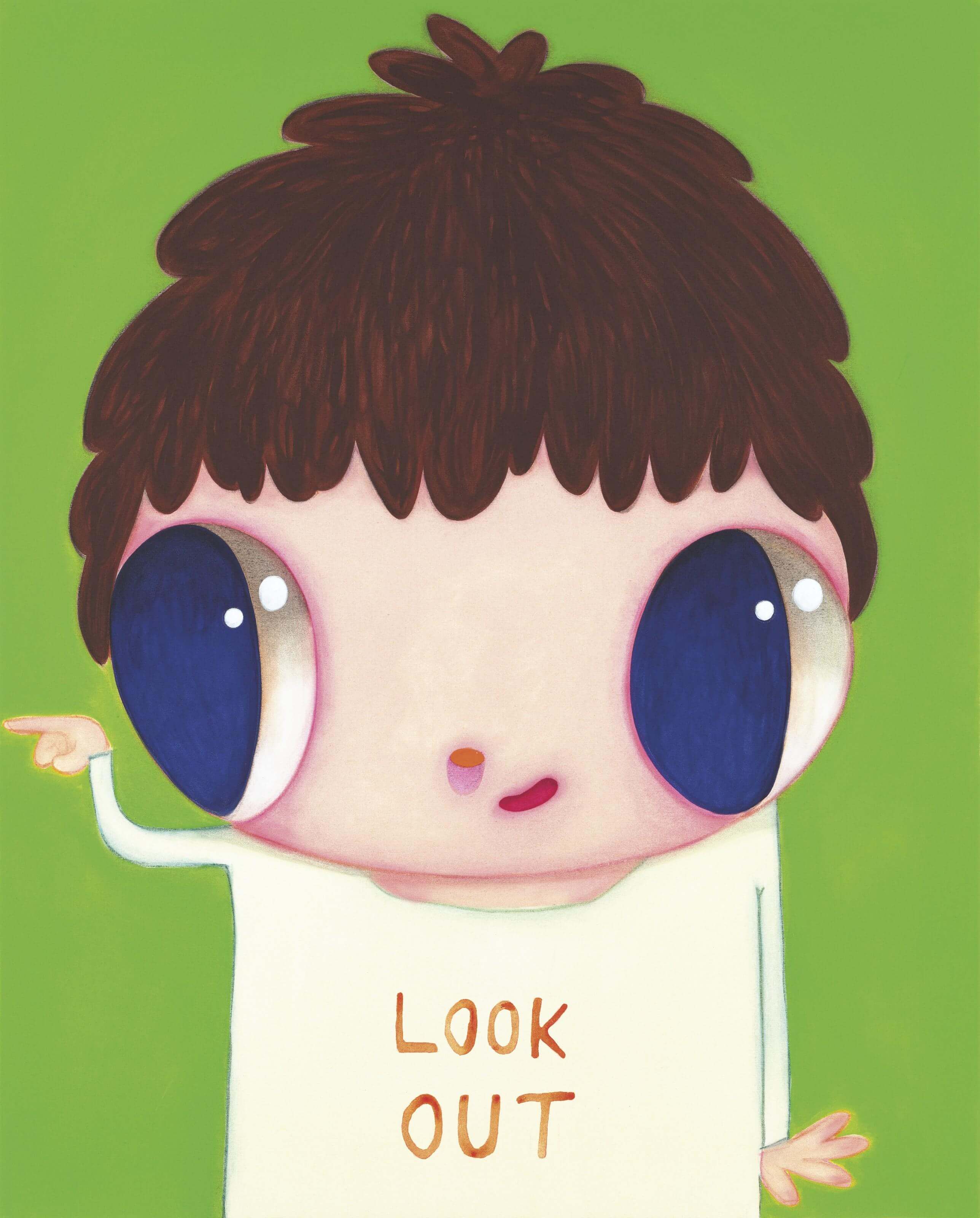

Javier Calleja

Javier Calleja2 artworks

-

Kaws

Kaws105 artworks

-

Keith Haring

Keith Haring192 artworks

-

Matt Gondek

Matt Gondek32 artworks

-

Mr.

Mr.28 artworks

-

Satoru Koizumi

Satoru Koizumi1 artwork

-

Takashi Murakami

Takashi Murakami342 artworks

-

Takeru Amano

Takeru Amano22 artworks

-

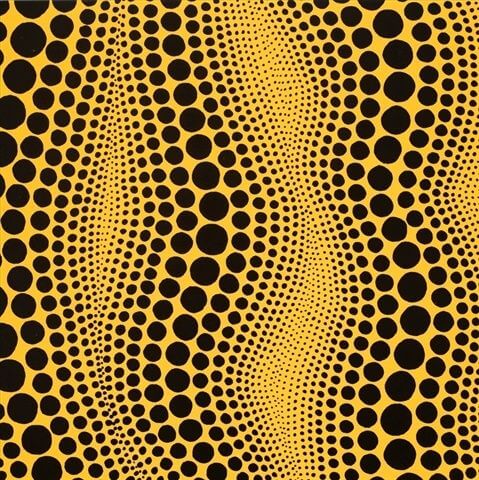

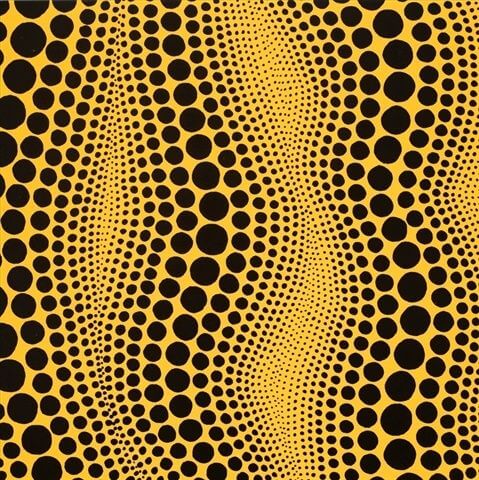

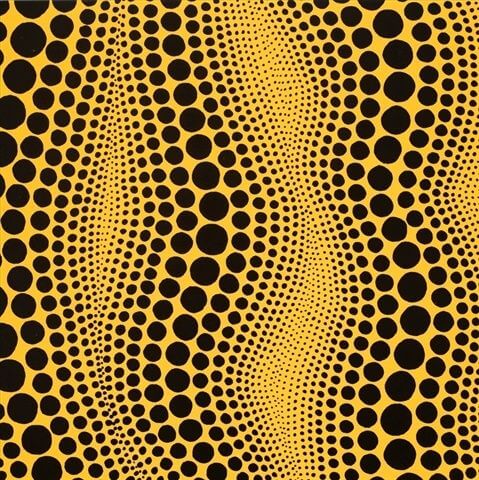

Yayoi Kusama

Yayoi Kusama153 artworks

-

- Sell

-

About

- Sale

- New Arrivals

- Most Popular

- All Prints

- Arists

- Sell

-

About

- the service

- How it Works

- Buy

- What is a print?

- Authenticity Guarantee

- the company

- About

- Contact us

- Login

-

ALEC MONOPOLY

ALEC MONOPOLY7 artworks

-

Alex Katz

Alex Katz133 artworks

-

Banksy

Banksy4 artworks

-

Bridget Riley

Bridget Riley1 artwork

-

Damien Hirst

Damien Hirst475 artworks

-

Hajime Sorayama

Hajime Sorayama126 artworks

-

Harland Miller

Harland Miller48 artworks

-

Invader

Invader72 artworks

-

Javier Calleja

Javier Calleja2 artworks

-

Kaws

Kaws105 artworks

-

Keith Haring

Keith Haring192 artworks

-

Matt Gondek

Matt Gondek32 artworks

-

Mr.

Mr.28 artworks

-

Satoru Koizumi

Satoru Koizumi1 artwork

-

Takashi Murakami

Takashi Murakami342 artworks

-

Takeru Amano

Takeru Amano22 artworks

-

Yayoi Kusama

Yayoi Kusama153 artworks

Art as an Alternative Investment: 12 Reasons To Invest Today

September 13, 2023 4 min read

In the diverse landscape of investments, traditional assets like stocks, bonds, and real estate have always been dominant players.

However, in the search for diversification and unique opportunities, more investors are turning towards non-traditional, or 'alternative' assets, with art emerging as a significant contender; andHype Museum are certainly seeing an influx in sales due to this.

Here are some reasons why art as an alternative investment could be right up your ally…

Art as an Alternative Investment: 12 Reasons To Invest

1. A Historical Perspective

For centuries, art has been a symbol of status, culture, and affluence. The Medici family in Renaissance Italy, for instance, was not just known for their banking prowess but also for their extensive art collections and patronage.

Art's intrinsic value, both culturally and monetarily, has stood the test of time. This historical precedent gives credence to its worthiness as an investment.

Throughout history, wars have been waged, economies have risen and fallen, but art remains - often appreciating in value and always in cultural significance.

2. Beyond Traditional Market Volatilities

One of the most compelling reasons for considering art as an alternative investment is its relative insulation from traditional market fluctuations.

Unlike stocks, which can be highly sensitive to factors like corporate performance or geopolitical events, art derives its value from a complex interplay of historical significance, artist reputation, rarity, and cultural trends.

This makes it less vulnerable to the short-term volatilities that characterize other investment avenues.

3. The Tangibility Factor

In an age where digital currencies and virtual assets are on the rise, there's a renewed appreciation for tangible investments. Art is not just a data point on a graph or numbers on a screen; it's a physical entity.

This tangibility provides investors with something real and enduring, a touchpoint to history, culture, and human expression. It's an asset that can be admired, displayed, and enjoyed, even as it potentially appreciates in value.

4. Potential for Outsized Returns

While art investment doesn't come with guaranteed returns, there have been instances where artworks have fetched exponentially higher prices than their initial purchase value. The contemporary art market, in particular, offers exciting possibilities.

Artists like Banksy, who began their careers with modest sales, now command prices that would have been unthinkable a few decades ago. Early investments in promising artists or genres can lead to significant returns down the line.

5. Driving Social and Cultural Impact

Art investment is not just a financial endeavor; it's a cultural and social one.

Investing in emerging artists or underrepresented genres can play a pivotal role in shaping the art narrative, promoting diversity, and driving cultural discourse.

Investors have the opportunity to be patrons, supporting artists and movements they believe in, thereby creating a lasting societal impact.

6. Enhanced Liquidity in the Digital Age

One of the traditional concerns with art investments was liquidity.

However, with the advent of digital platforms and online auction houses, this landscape is evolving.

Digital marketplaces facilitate quicker and broader sales, connecting buyers and sellers from across the globe. This has enhanced the liquidity of the art market, making it more accessible and dynamic.

7. Navigating the Complexities

Theworld of art investments is nuanced and requires a discerning eye.

Factors like authenticity, provenance, and market trends can significantly influence an artwork's value.

Potential forgeries, over-hyped artists, or shifts in cultural preferences can pose challenges. Therefore, potential investors should seek expert opinions, conduct thorough research, and approach the art market with both passion and pragmatism.

8. Art Securitization and Fractional Ownership

With technological advancements, newer ways of investing in art are emerging. Art securitization and fractional ownership are leading this revolution. Rather than purchasing an entire artwork, investors can buy a 'fraction' or a 'share' of the piece.

This means that masterpieces which were once available only to the ultra-rich are now accessible to average investors.

Platforms like Masterworks or Myco allow this fractionalized investment, bringing the world of elite art investments to a broader audience. This democratization not only provides more access but also introduces liquidity to an otherwise static investment.

9. Art as a Loan Collateral

Banks and financial institutions are increasingly recognizing the value of art. Prestigious artworks are now being accepted as collateral for loans. This trend highlights the growing financial credibility of art.

For collectors, it provides an avenue to unlock the value of their collection without selling it.

This capability bridges the gap between passion and practicality, allowing collectors to leverage their artworks for other financial opportunities.

10. The Rise of Art Funds

Like mutual funds for stocks and bonds, art funds pool resources from multiple investors to purchase a diverse range of artworks. Managed by art professionals and investment experts, these funds aim to provide returns through the appreciation of their art portfolios.

This offers a hands-off approach for investors who are keen on the art market but might lack the expertise or desire to manage individual pieces.

11. Environmental Considerations and Art Conservation

Art, especially when it involves materials that degrade over time, requires conservation. Investments might need to factor in the costs of maintaining the artwork in pristine condition. Moreover, the art world is also increasingly focusing on sustainability.

Artists are using eco-friendly materials, and galleries are highlighting sustainable practices.

For the socially conscious investor, this adds another layer of value – the chance to support and invest in artworks that are not just financially, but also environmentally sound.

12. Art and Technology Interplay

The intersection of art and technology is birthing new forms of art, like digital art and NFTs (Non-Fungible Tokens).

Platforms like SuperRare or Foundation have made headlines with sales of digital art pieces, backed by blockchain technology, fetching astounding prices.

For the modern investor, this is an uncharted yet exciting territory, expanding the definition and scope of what can be considered 'art' in the investment realm.

Conclusion

Art, as an alternative investment, offers a journey that transcends mere financial gains. It's a voyage through history, culture, and human expression.

While the potential for appreciable returns exists, the true value of art lies in its enduring significance, its stories, and its ability to connect us through time and space.

As more investors recognize this, art as an alternative investment is only going to get more traction. There is no doubtart is poised to carve a prominent niche in the world of alternative investments.

Leave a comment

Subscribe

Sign up to get the latest on sales, new releases and more …